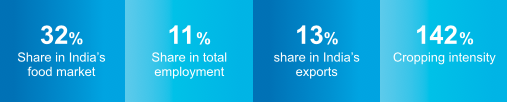

Food is very essential and considered to be an inherent factor and strong backbone of any countries economic growth. In India, the food industry is estimated to be USD 543 Bn in FY 2020 at CAGR growth of 14.6%.

The diversity in Indian culture and changing needs of customers create further complexity in the food production and distribution system in the country. A number of changes are shaping the Indian food landscape with disruptions in business models of companies, in terms Current State of Food Ecosystem Cultivation Agri- logistics Communication Product and Service Flow Future State of Food Ecosystem Food Service Food Retail of their interaction with consumers and responsiveness to their needs. While packaged food is the fastest growing segment posting a double digit growth yoy, currently only ~10% of agri-produce is being processed in India.

Food Ecosystem in India

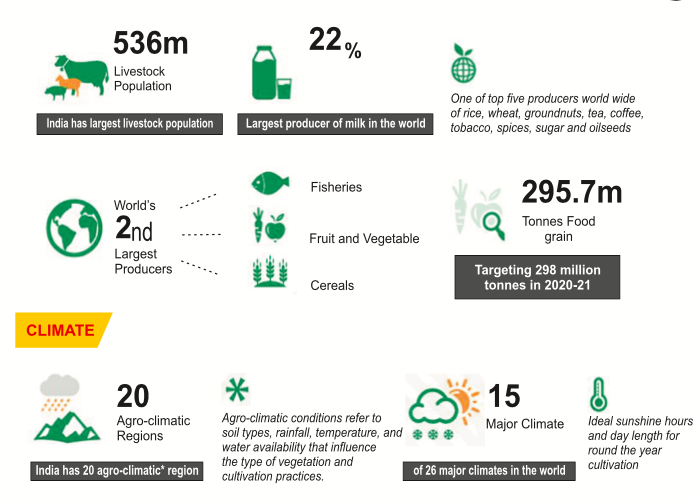

India is the 7th largest country with an area of 31.7mn square kms, the 2nd most populous country and the 2nd largest producer of food in the world. The task of ensuring that the food produced reaches 1.2 Bn Indians is complex and involves a number of stakeholders. About 210mn farmers and agriculture labourers cultivate various crops which they harvest and sell in Agriculture Produce Market Committee (APMC) markets or ‘mandis’. There are 2,477 APMCs and 4,843 sub- market yards regulated by the respective states in India. Multiple levels of value addition activities are undertaken on the agri-produce in a food processing plant, which in turn produces the packaged and processed food products. There were 38,608 registered food processing units in FY 15. Distribution in India involves serving a large fragmented base of kirana shops. There are 14,000 organized retail outlets concentrated largely in urban areas. Unorganized retail consists of 12-14mn stores spread over 5,000 towns and 600,000 villages across India. The diversity in Indian culture and changing needs of customers creates further complexity in the food production and distribution system in the country.

Key Segments in the Food Value Chain

Key highlights of Food processing industry

- The Processed food market is expected to grow to $543 bn by 2020 from $322 bn in 2016, at a CAGR of 14.6%

- Food processing has an important role to play in linking Indian farmers to consumers in the domestic and international markets

- The Ministry of Food Processing Industries (MoFPI) is making all efforts to encourage investments across the value chain

- The industry engages approximately 1.77 million people in around 39,319 registered units with fixed capital of $29.2 bn and aggregate output of around $144.6 bn

- The key sub-segments of the Food Processing industry in India are: Dairy, Fruits & Vegetables, Poultry & Meat processing, Fisheries, Food retail etc.

- Egg production of around 88.1 billion during 2016-17 and total fish production in 2016-17 was 11.41 million tonnes

- Food Retail market is majorly dominated by Food Grocery (growing at CAGR 25%) and Food Services (growing at CAGR 15%) segments

Food Producer

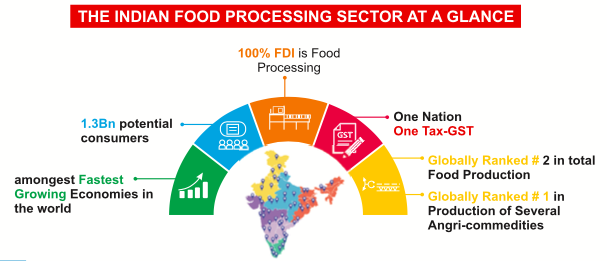

FDI Facts For Food Processing Industries.

- $9 bn inflows from FDI in food processing industries during April 2000 – March 2019

- $328 bn FDI equity inflows over April 2014 – March 2019

- 22% Share in total FDI inflows

India’s food ecosystem offers huge opportunities for investments with stimulating growth in the food retail sector, favourable economic policies and attractive fiscal incentives. The Government of India through the Ministry of Food Processing Industries (MoFPI) is also taking all necessary steps to boost investments in the food processing industry. The government has sanctioned 42 Mega Food Parks (MFPs) to be set up in the country under the Mega Food Park Scheme. Currently, 17 Mega Food Parks have become functional.

By 2020, Indian Food and Retail market is projected to touch $828.92 bn, while the dairy industry is expected to double to $140 bn.

100% FDI in the food processing sector in India is permitted under the automatic route.

100% FDI in food processing is allowed through government approval route for trading, including through e-commerce in respect of food products manufactured or produced in India.