The pandemic impact was clearly visible on the generator market in India, as many manufacturing plants were shut down to curtail the spread of the disease. The production of generator was temporarily put on hold, and the demand for generators in 2020 also decreased due to the lockdown of various commercial establishments, including retail stores, offices, hotels, and airports. The reduction in the demand resulted in a price drop for diesel generator, which further hampered the market progress.

However, as per recent market reports the business players in the generator market are chalking out various strategies to be adopted or being adopted across the globe at various levels in the value chain. In the view of the global economic slowdown, the report estimated that China, India, Japan and South Korea to recover fastest amongst all the countries in the Asian market.

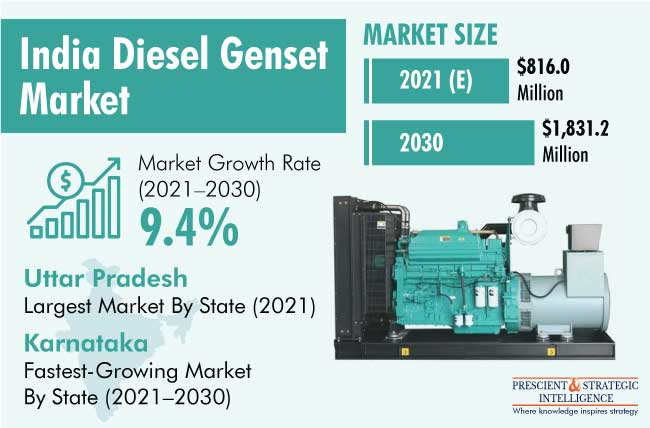

As per market reports the market is expected to reach $3,006.6 million by 2030, from $1,385.6 million in 2019 at a healthy 13.3% CAGR between 2020 and 2030. The biggest reason for the rising demand for these electricity production systems is the substantial demand for the uninterrupted power supply in various sectors.

Demand of generators in power category

Power is among one of the most important components of infrastructure, vital for the economic growth and prosperity of nations. The existence and development of suitable infrastructure is essential for constant growth of the Indian economy.

India’s power sector is one of the most diversified in the world. Sources of power generation range from conventional sources such as coal, lignite, natural gas, oil, hydro and nuclear power to viable non-conventional sources such as wind, solar, and agricultural and domestic waste. Electricity demand in the country has increased rapidly and is expected to rise further in the years to come. In order to meet the increasing demand for electricity in the country, massive addition to the installed generating capacity is required.

Indian power sector is undergoing a significant change that has redefined the industry outlook. Sustained economic growth continues to drive electricity demand in India. The Government of India’s focus on attaining ‘Power for all’ has accelerated capacity addition in the country. At the same time, the competitive intensity is increasing at both the market and supply sides (fuel, logistics, finances, and manpower).

As per reports, for FY21, electricity generation attained from conventional sources was at 1234.44 BU, comprising 1,032.39 BU of thermal energy; hydro energy (150.30 BU) and nuclear (42.94 BU). Of this, 8.79 BU was imported from Bhutan.

NTPC Ltd.’s oldest unit in Singrauli, Uttar Pradesh, has achieved the highest Plant Load Factor (PLF) of 100.24% among all thermal units in the country between April 2020 and December 2020. In FY22 (until September 2021), the total thermal installed capacity in the country stood at 234.02 GW. Installed capacity of renewable, hydro and nuclear energy totalled 101.53 GW, 46.51 GW and 6.78 GW, respectively.

Multifarious initiatives proposed by the Indian government to stimulate the development of various sectors in the coming years. Make in India campaign, development of smart cities, Saubhagya scheme along with housing for all 2022, are some of the major plans which might favour the development of power utilities and development of manufacturing infrastructure verticals in the country. As per Ministry of Petroleum and Natural Gas of India, out of the total diesel consumption, 6-8% was consumed for power generation which includes grid-connected diesel-based power plants of more than 10 MW, captive diesel-based power plants, and diesel generator sets.

There are two predominant categories of electrical generators, those that use non-renewable energy sources, and those that use renewable energy.

While growth in solar energy is a good sign for the country, thermal energy has been the primary source for the power sector, and will continue to remain an important source of power in the future. Further, given that renewable energy sources are intermittent in nature, a balancing power will be needed to support the grid and even out the fluctuations. For example, if solar energy is being used in an area, it will require an alternate source for the night time requirement.

.

Demand of generators in construction category

Presently, the world is witnessing the increase in the demand for power at a significant pace. Thus, it has become of utmost importance of having a reliable source of power. The increasing frequency of natural calamities leading to power outages is also creating the need of standby generator sets. A steady and uninterrupted flow of electricity is a prime concern for all industries. The need of uninterrupted power supply in construction industry is also creating a space for the utilization of generator sets leading to growth of this market.

A lot of equipment used in construction work requires electric power, as sites are unable to get the grid supplies as most of the times they are in remote areas. While excavators, backhoes, bulldozers and road rollers are self-powered there are other machineries such as air compressors, hand drills, chain saws, battery chargers, electric welders amongst other equipment that requires motive power, which is supplied by these large capacity generators. During the nightshifts construction sites require sufficient lighting and a lot of administrative tasks requires computers which are also powered by these generators. The standby generators are the main source of power in construction activities.

The availability of power is even more vital as developers are becoming increasingly inclined towards building affordable housing projects. The Housing for All initiative aims to build 20 million affordable housing units across India by 2022. Attracted by growing job opportunities in cities, consumer demand for affordable housing has increased exponentially. Large capacity generators will be a driving force of this growth.

The demand for such systems is predicted to increase the fastest in Karnataka in the coming years because of the growth in its residential and commercial real estate sector. For instance, the Government of India is planning to invest $15.68 billion (INR 1.16 lakh crore) in infrastructure projects in the state, while the Karnataka government would construct 900,000 houses in the coming years.

As the awareness regarding ecological responsibility is on the rise, these has been advancements in the research and developments aiming towards reducing the emissions of greenhouse gases from the generators into the environment. As a result natural gas powered generators are gaining popularity among the different sectors of businesses.

Demand of generators in commercial category

The need for a consistent power backup source is further creating the demand for diesel generators from commercial sectors like hotels, hospitals and commercial offices. Additionally, increasing focus of telecom companies towards delivering high-speed services is also supporting the growth of diesel generator market. With growing investment in telecom sector and increasing installation of telephone towers for connectivity in remote locations, the market is anticipated to undergo significant growth through FY2026.

The above-15 kVA category has held the largest share in the Indian generator market, based on power rating. Commercial complexes, residential facilities, restaurants, small industrial units, and telecom towers widely deploy these generator to meet their auxiliary electricity demands. As the number of residential societies and commercial complexes increases in the country, so will the demand for above-15 kVA generator.

In the years to come, the commercial category will dominate the Indian generators’ market. The installation rate of generator is rising rapidly in restaurants, telecom towers, hospitals, hotels, malls, and various other commercial settings. The highest value CAGR in the Indian generator market, of 14.0%, is predicted to be seen by generator with an above-400 cc engine capacity. The commercial and industrial sectors, where the electricity requirement is always high, require generator with a higher engine capacity, for reliable operations. Moreover, if the power load increases suddenly, higher-engine-capacity generator are able to respond quickly.

The Asia-Pacific region holds the major share of the global commercial standby generator sets market due to the rapid urbanization and increases in power supply in the emerging economies such as India and China.

Demand of generators in industrial category

Increasing demand from several industries such as mining, oil and gas, and pharmaceuticals is expected to contribute to the growth of the generator manufacturing market in the forecast period. Generators are used as a source of power backup in many industrial activities.

However in cases where grid infrastructure is absent, generators are used as the only source of power. For example, majority of the mining sites are located in remote locations, and require generators for their day-to-day power requirements. For instance, mining market in India is expected to increase from $105 billion in 2018 to $126 billion in 2022 at a CAGR of 4.63%. Economic growth in emerging markets is increasing the industrial activity which in turn will drive the market for generators in the forecast period.

Generator manufacturing companies are increasingly manufacturing portable generators. A portable generator provides electricity by running a gas-powered/diesel-powered engine that turns an on-board alternator to generate electrical power. Rising demand for uninterrupted and reliable power supply is increasing the demand for portable generators. Portable generators offer several advantages such as flexibility, and increased ease of use. The global portable generators market is expected to reach $2.5 billion by 2024.

Furthermore, the rising number of data centres is also providing impetus to the growth of the generator market, as data centres make sure to have multiple backup power options in order to avoid disruption in work during power failure.

Conclusion

In terms of both volume and value, the largest share in the market has been held by the 5 kVA–75 kVA category in 2021. This can be attributed to the high-volume demand for these generator from residential facilities, commercial complexes, small industries, restaurants, and telecom towers. Furthermore, macroeconomic growth in the country and surge in the number of construction and infrastructure projects are expected to result in a high demand for these generator for meeting prime and auxiliary power requirements. Further, these generators are rather popular in the telecom sector; thus, with the increase in the installation of telecom towers, the demand for 5kVA–75kVA generators is rising.

On the basis of end use industry, commercial segment holds the largest share, in terms of revenue, and is expected to grow at a CAGR of 9.9%. This is attributed to the increase in demand from the commercial sites such as shops, complexes, malls, theatres, and other applications.

Therefore, the commercial segment is expected to continue to dominate the market due to its large capacity and increase in electricity demand in the country. High demand is also likely to come from the building construction and healthcare industry due to their high growth and features like the requirement of immediate electricity, high voltage for electrical equipment, which prefers methods akin to diesel generators.

In the global market, the presence of the developing countries such as China, Japan, Australia, and India is anticipated to contribute toward the growth of the diesel generator market in Asia-Pacific. In Apr 2019 – Apr 2020 period, the monitored producing capacity of commercial power producer of diesel generators was approximately 10667 MW. The segment accounted for the highest usage among all of the other sectors. It is expected to remain the most significant power generation provider in the forecast period.

Finally, end user of the power generation application is focussing on reliability than durability. Government’s efforts to bring down power deficit has brought down the running hours of power generation application significantly, especially in urban and developed metro cities.

Therefore, power generation customers have reduced their focus on the durability of the product. They are now focussed on reliability .They want their generator set to be available to start generating backup power whenever the need arises.