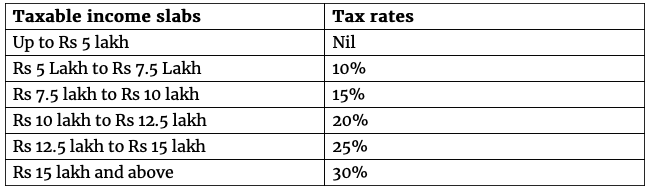

* To simplify the tax system and lower tax rates, around 70 of more than 100 income tax deductions and exemptions have been removed.

* Dividend Distribution Tax (DDT) abolished; Companies will not be required to pay DDT; dividend to be taxed only at the hands of recipients, at applicable rates.

* Cash reward system envisaged to incentivise customers to seek invoice.

* 15% concessional tax rate for new power generation companies.

* Tax on cooperative societies reduced to 22% without exemptions.

* 100% tax concession to sovereign wealth funds on investment in infrastructure projects.

* Tax on Cooperative societies to be reduced to 22 per cent plus surcharge and cess ,as against 30 per cent at present.

* To end tax harassment, new taxpayer charter to be instituted. Tax harassment will not be tolerated, says FM.

* To amend I-T Act to allow faceless appeals.

* To launch new direct tax dispute settlement scheme — Vivaad se Vishwaas scheme.

* Interest and penalty will be waived for those who wish to pay the disputed amount till March 31.

* Government to look at ensuring that contracts are honoured.

* Proposes new National Policy on Official Statistics to improve data collection and dissemination with ..

* Rules of origin requirements in Customs Act to be reviewed, to ensure FTAs are aligned with the conscious direction of our policy: FM

* Aadhaar-based verification of taxpayers is being introduced to weed out dummy or non-existent units; instant online allotment of PAN on the basis of Aadhaar.

* Registration of charity institutions to be made completely electronic, donations made to be pre-filled in IT return form to claim exemptions for donations easily.

Housing:

* Tax holiday for affordable housing extended by 1 year. Additional deduction up to Rs. 1.5 lakhs for interest paid on loans taken for an affordable house extended till 31st March, 2021.

Investment:

* Govt plans to sell part of its holding in Life Insurance Corporation (LIC) by way of Initial Public Offering.

* Certain specified categories of government securities will be open fully for NRIs

apart from being open to domestic investors

* FPI limit in corporate bonds raised to 15% from 9%.

* Government doubles divestment target for the next fiscal at Rs 2.1 lakh crore.

* Expand Exchange Traded Fund by floating a Debt ETF, consisting primarily of govt. securities.

Indirect Tax :

* Customs duty raised on footwear to 35% from 25% and on furniture goods to 25% from 20%.

* Excise duty proposed to be raised on Cigarettes and other tobacco products, no change made in the duty rates of bidis.

* Basic customs duty on imports of news print and light-weight coated paper reduced from 10% to 5%.

* Customs duty rates revised on electric vehiclesand parts of mobiles.

* 5% health cess to be imposed on the imports of medical devices, except those exempt from BCD.

* Lower customs duty on certain inputs and raw materials like fuse, chemicals, and plastics.

*Higher customs duty on certain goods like auto-parts, chemicals, etc. which are also being made domestically.

Startups & MSME:

* Tax burden on employees due to tax on ESOPs to be deferred by five years or till they leave the company or when they sell, whichever is earliest.

* New Simplified return for GST from April 2020

* Start-ups with turnover up to Rs. 100 crore to enjoy 100% deduction for 3 consecutive assessment years out of 10 years.

* Turnover threshold for audit of MSMEs to be increased from Rs 1 crore to Rs 5 crore, to those businesses which carry out less than 5% of their business in cash.

* App-based invoice financing loans product to be launched, to obviate problem of delayed payments and cash flow mismatches for MSMEs.

* Amendments to be made to enable NBFCs to extend invoice financing to MSMEs

Fiscal numbers & allocations:

* FY20 fiscal deficit revised to 3.8% from 3.3% in the current fiscal. For FY21, fiscal target seen at 3.5%.

* Deviation of 0.5%, consistent with Section 4(3) of FRBM Act.

* Net market borrowing for FY20 at Rs 4.99 lakh crore; For FY21 it’s pegged at Rs 5.36 lakh crore.

* Nominal GDP growth for 2020-21 estimated at 10%.

* Receipts for 2020-21 estimated at Rs 22.46 lakh crore. Expenditure at Rs 30.42 lakh crore.

* Defence gets Rs 3.37 lakh crore as the defence budget

* Rs 2.83 lakh crore to be allocated for the 16 Action Points; Rs 1.6 lakh crore allocated to agriculture and irrigation; Rs 1.23 lakh crore for Rural development and Panchayti Raj.

* Rs 4,400 crore for clean air; Rs 53,700 crore for ST schemes; Rs 85,000 crore for SC, OBCs schemes; Rs 28,600 for women specific schemes; Rs 9,500 crore for senior citizen schemes.