Electric Motor Market by Type (AC Motor, DC Motor, and Hermetic Motor), Output Power (IHP and FHP), Voltage Range (9 V & below, 10-20 V, 21-60 V, 60 V & Above), Application (Industrial Machinery, Motor Vehicle, HVAC Equipment, Aerospace & Transportation, and Household Appliances) & Speed (Low-speed, Medium-speed, High-speed, Ultrahigh-speed): Global Opportunity Analysis and Industry Forecast, 2018–2025

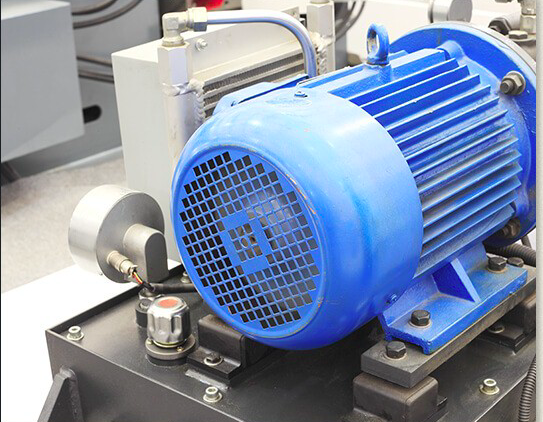

The global electric motor market size was $96,967.9 million in 2017, and is projected to reach $136,496.1 million in 2025, growing at a CAGR of 4.5%. The electric motor converts electrical energy into mechanical energy. Its components include rotor, bearings, stator, air gap, windings, and commutator. Factors such as angular movements, torque requirements, acceleration, speed, and control make AC motors an ideal choice for robotic system manufacturers.

Shunt, series, permanent magnetics, and others are different types of DC motors, while synchronous machines, reluctance motors, and others are different types of AC motors. Electric motors commonly find applications in OEM based products, pumps, conveyor systems, compressors, fans, and industrial machineries. AC and DC motors can be developed through integration of electronic hardware and sensors that offers predictive maintenance and reduces downtime during maintenance.

The rise in demand for superior machine control in automotive industry, owing to the high efficiency of AC synchronous motors fuels the electric motor market growth. The regulations such as Minimum Energy Performance Standards (MEPS), drives the growth of energy efficient electric motors market across the world. The material handling systems serve as the key consumers of fractional horsepower (FHP) motors, thus boosting their demand across the globe. Moreover, the adoption of motors ranging 21-60 V in HVAC sectors, owing to the heat dissipation, are anticipated to exhibit high demand for these motors in the coming years.

However, the industrial motors with high power rating generate substantial vibration, strain, and heating during their performance, which could potentially have profound influence over electronic components, and result in their malfunction. In addition, lack of awareness of benefits associated with smart motors among small and medium enterprise owners for various applications is expected to hinder the growth of the electric motor market during the forecast period.

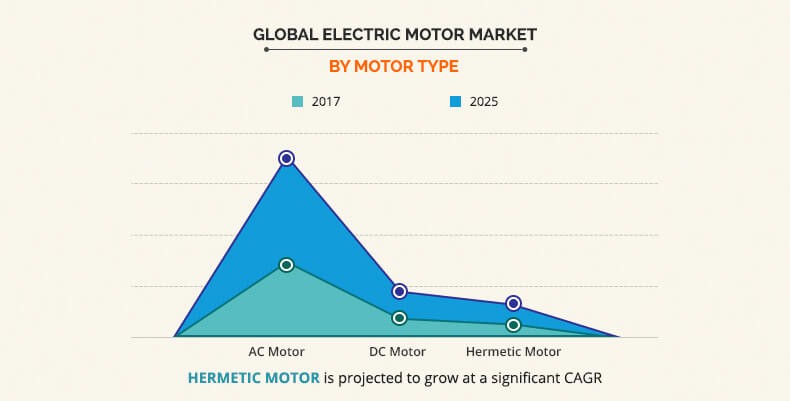

The global electric motor market is segmented into motor type, output power, voltage range, application, speed, and region. Based on motor type, the global market is divided into AC, DC, and hermetic motors. AC motors has two subsegments, which includes synchronous AC motors, and induction AC motor. Similarly, DC motor is further classified as brushed DC motor and brushless DC motor. In 2017, the AC motor segment held the largest share, due to increase in demand for energy-efficient conveyor systems in manufacturing and automotive industries. Based on output power, it is classified into integral horsepower (IHP) output, and fractional horsepower (FHP) output. By voltage range, the market is categorized into 9 V & below, 10-20 V, 21-60 V, and 60 V & above. In 2017, the 60 V & above motor segments held the largest share, due to its increase in demand in heavy industrial machinery industry for energy-efficient conveyor systems in manufacturing and automotive industries.

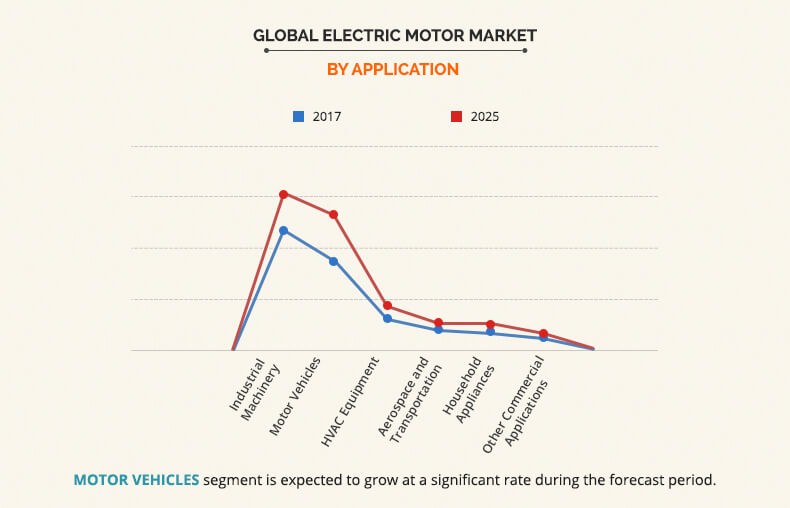

Based on application, the global electric motor market is classified into industrial machinery, motor vehicles, heating, ventilating, and cooling equipment (HVAC), aerospace & transportation, household appliances, and other commercial applications. In 2017, the industrial machinery segment held the largest share, due to increase in demand for compressors systems in manufacturing and automotive industries. Based on speed (rpm), it is classified into low-speed electric motors (less than 1,000 rpm), medium-speed electric motors (1,001-25,000 rpm), high-speed electric motors (25,001-75,000 rpm), and ultrahigh-speed electric motors (greater than 75,001 RPM).

Region wise, the electric motor market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2017, North America accounted for the highest share, and is anticipated to secure the leading position during the forecast period. This is attributed to industrial growth and expansion of aerospace industry. U.S. is a pioneer in the electric motor market. Therefore, the electric motor market share is highest among the North American countries.

COMPETITION ANALYSIS

The major players operating in the global electric motor market include Ametek Incorporation, Siemens AG, Baldor Electric Incorporation, Allied Motion Technologies Inc., ARC Systems Incorporation, Asmo Corporation Limited, Brook Crompton UK Limited, Franklin Electric Cooperative Incorporation, Rockwell Automation Incorporation, and Johnson Electric Holdings Limited.

Key players in the global electric motor market adopted partnership and product launch as its key developmental strategy to expand its business and improve its product portfolio. For instance, in January 2019, WEG S.A, and Spanish private firm, a leading provider of pork signed partnership agreement. According to the agreement Spanish private firm has installed W22 Magnet IE4 electric motors in refrigeration system at the Manresa facilities. Similarly, in December 2017, Nord Drivesystems launched IE4, AC synchronous motors for applications in food & beverage industries. Through this move Nord expanded its portfolio of PM synchronous motor.

Key Benefits For Electric Motors Market:

- The report provides an extensive analysis of the current and emerging market trends and dynamics in the global electric motor market.

- In-depth electric motor market analysis is conducted by constructing market estimations for the key market segments between 2017 and 2025.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The study provides an in-depth analysis along with the electric motor market trends and estimations to elucidate the imminent investment pockets.

- The global electric motor market forecast analysis from 2018 to 2025 is included in the report.

- Key market players within the electric motor market are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the global electric motor industry.

Global Electric Motor Market Segments:

By Motor Type

- Alternate Current (AC) Motor

- Synchronous AC motors

- Induction AC motor

- Direct Current (DC) Motor

- Brushed DC motor

- Brushless DC motor

- Hermetic Motor

By Output Power

- Integral Horsepower (IHP) Output

- Fractional Horsepower (FHP) Output

By Voltage Range

- 9 V & Below

- 10-20 V

- 21-60 V

- 60 V & Above

By Application

- Industrial machinery

- Motor vehicles

- Heating, ventilating, and cooling (HVAC) equipment

- Aerospace & transportation

- Household appliances

- Other commercial applications

By Speed (RPM)

- Low-Speed Electric Motors (Less Than 1,000 RPM)

- Medium-Speed Electric Motors (1,001-25,000 RPM)

- High-Speed Electric Motors (25,001-75,000 RPM)

- Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Players

- ABB Group

- ARC Systems, Inc.

- Asmo Co., Ltd.

- Brook Crompton UK Ltd.

- Dr. Fritz Faulhaber GmbH

- Emerson Electric

- Maxon Motors AG

- Regal Beloit Corporation

- Rockwell Automation, Inc.

- Siemens AG