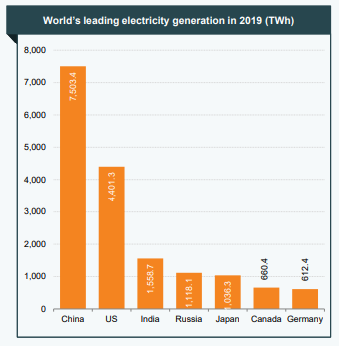

Power sector in India is one of the most diversified sectors of the world. India ranks third in the largest producer and second in the largest consumer of electricity in the world. As per the records of October 2020, the total installed power capacity of India was approx 373 GW. Power is one of the most crucial element of infrastructure and the development of existing infrastructure is beneficial for the sustained growth of Indian economy. There are primarily two sources of power generation that are conventional and non-conventional sources of energy.The conventional source of energy include coal, natural gas, oil, lignite, hydro and nuclear power while the non-conventional sources include wind, solar, and domestic waste.

The demand of Electricity has increased significantly and is expected to increase more in the upcoming years. In order to fulfil the rising demand of electricity, it is important to expand the present installed generating capacity. As per the report of Lowy Institute Asia Power Index 2021, India stood at 4th ranking of the most powerful country in the Asia-Pacific region for comprehensive power out of 26 countries, with an overall score of 37.7 out of 100. In FY2022, solar energy is expected to contribute 114 GW, followed by 67 GW from wind power and 15 GW from biomass and hydropower. The target for renewable energy has been increased to 227 GW by 2022.

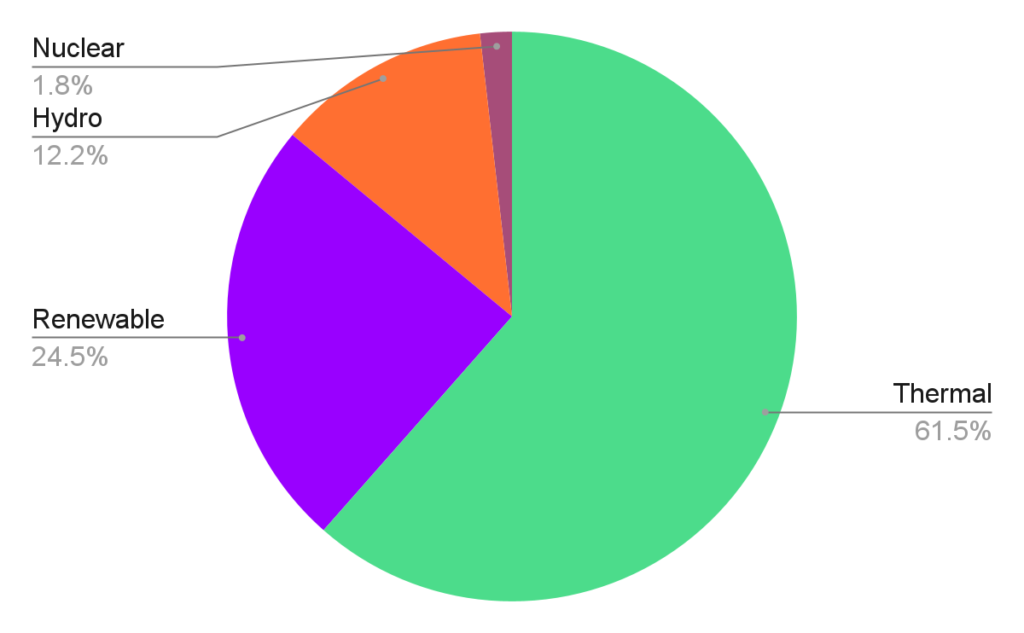

In FY22 (until October 2021), the total thermal installed capacity in the country stood at 234.44 GW. Installed capacity of renewable, hydro and nuclear energy totalled 103.05 GW, 46.51 GW and 6.78 GW, respectively.

As of September 2021, the total renewable energy capacity of India was 101.53 GW which is approx 38% of the overall installed capacity . India has set an ambitious target to generate 450 Gigawatt of installed energy from renewable by 2030 out of which 280 GW i.e approximately 60% is expected from solar. India stood at sixth position in the list of countries to make significant investments in clean energy at US$ 90 billion. India is the only country among the G20 nations that is on track to achieve the targets under the Paris Agreement.

A significant change has been observed in the Indian power sector which has redefined the entire outlook. Due to sustained economic growth, the electricity demand in India has increased rapidly. The focus of the Government of India to provide “Power for All” has accelerated the capacity addition in the country. The requirement of fuel, logistics, manpower as well as finances is increasing on both the market and on the supply sides.

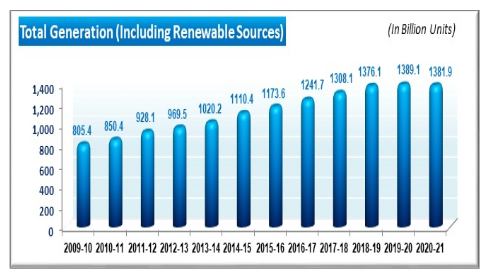

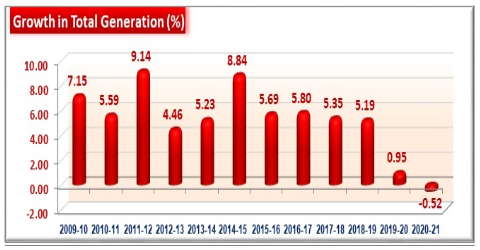

Source: Ministry of power

Source: Ministry of power

Under the Saubhagya scheme, India has been working continuously to achieve 100% electrification of households. Under this scheme, more than 26.2 million households were electrified as per records in March 2019. Around 139 GW of installed capacity and 1.41 lakh circuit km of transmission lines were added and 2.8 crore households were connected in the past 6 years according to Union Budget 2021-22.

As per study conducted in February 2021, India ranks third in the largest producer and second in the largest consumer of electricity in the world with the total installed power capacity of 379 GW. India stands fourth in Renewable power installed capacity out of which it ranks fifth in wind and solar power. Currently India is the only country among G20 Nations which is on track to achieve the set target under Paris Agreement.

Power Sector in India

The three crucial segments in the power sector are: Generation, transmission and distribution.

Generation: It refers to the process of producing power i.e electricity from conventional or non conventional sources of energy. These consist of solar, wind, hydro and biomass. The electrical power is generated in the generating station. Transmission: It refers to the process carrying bulk power from the generating station to the distribution substation at high voltage.

Distribution: It refers to the process of carrying electricity from the substation to the individual small and big consumer through a distribution network.

The generation capacity of India has increased considerably in the last two decades. This increase is accredited to de-licensing of power generation which enabled unrestricted participation of private sector in the year 2003 due which presently approx 46% of the power in the country is being generated by the power utilities, followed by 30 % of power generation by state utilities and 24% by the central generating utilities.

Strategies adopted to enhance the critical infrastructure of Power sector

Regulate the cost of generation: In order to control the cost of generation, companies are ensuring uninterrupted supply of power by developing captive coal fields which also help to reduce the cost of fuel transport.

Securing Fuel supply: Power companies are taking adequate measures in securing supplies of fuel from domestic as well as overseas resources like Reliance power has acquired coal reserves in Indonesia. Government has also empowered the power utilities to swap their existing coal supplies with the nearest available source in order to decongest the rail network. This is further help to minimise the miscellaneous as well the transportation cost.

Implementing different generation technologies: Power companies are implementing diverse generation techniques like coal- fired, gas-fired and hydroelectric capacity in order to reduce their dependence on single source. NTPC and Reliance power have already adopted these technologies.

Smart grid: Under the Digital India programme , Smart grid mission was launched with 14 DISCOMS as pilot programmes. Smart metering is being promoted for high end users of electricity.

Aatma Nirbhar Bharat: Government of India is empowering the power utility companies to manufacture all the key components of projects in India in order to reduce the dependency on exports.

Carbon credit: Power utility companies are selling their carbon credit for generating additional sources of revenue along with improving the environment by using advanced technologies.

Electrification of Energy demand:

Electricity and hydrogen are carriers of energy and do not pollute the environment at the point of consumption. The all India electricity demand during the period from April 2021 to September 2021 has increased by 12% on year on year basis (Y-o-Y).

The share of electricity in energy demand needs to be stepped up to check air pollution in habitations. Efforts needs to be made to include solid and liquid fuels along with renewables . This would help ramp up the demand of renewable power too.

Phasing out and removing old, inefficient coal fired power plants:

One of the greatest challenge in the power generation sector is enhancing present capacity of the power sector. However, there needs to be environment consciousness in generation. Older power plants that guzzle fuel and emit large volumes of fumes, especially close to cities, need to be phased out.

Geographic location of power plants: New power plants ought to be so sited that they do not damage air quality in human habitations. Water supply to power plants ought to be priced as per its scarcity value, so that concessional water tariffs do not spur growth of thermal plants in water stressed regions.

Clean coal technologies: India’s dependence on coal is expected to remain high. But, the Indian coal is known to have high ash content and low calorific value, which aggravates the air quality via poor thermal efficiency.

Energy from Biomass: The aggravation of urban air quality standards by stubble burning can be turned into an opportunity by promoting power plants based on agri-residues. A comprehensive Bio-energy Policy would lay the roadmap for promoting these plants which would also harness this resource, while addressing air quality concerns.

Urban Sector: Improving air quality cannot merely be a function of low emission technologies, and is also impacted by efficiency of transportation and uptake of clean energy. Smart city planning includes providing adequate transport spaces and transit orientation. Circular roads, Metro rail and MRTS facilities ought to be provided in city planning.

Other Interventions Beside focused action on above specified issues, an improved ecosystem is essential to drive clean energy deployment via investments in multiple areas. Global environmental concerns are spurring clean energy technologies and green growth. Our energy pathways must be ready to assimilate the emerging technologies which are likely to become affordable as they mature and scale-up. The cost of externalities will also need to be factored into costing so as to promote the viability of cleaner options. Urban administrations need to take note of the above, and harness such investments in economic growth. Additionally, there is a need to address the heating requirement of Industry through clean energy sources, as heat comprises the major share of Industry’s energy requirement.

Similarly, space cooling is likely to emerge as a major energy guzzler and a dedicated strategy to provide efficient cooling solution needs to be devised for the country. Looking to the inter-sectorial issues in the wide area of clean energy as discussed above, an inter-ministerial empowered agency will be set up to oversee implementation of these provisions.

The NEP aims at supporting the Indian ambition to emerge as a well-developed and resilient economy with high level of human development. Additionally, it helps prepare the nation to anticipate the technological and market related changes in the energy sector

Demand-driven provision of energy at affordable prices, high per capita consumption of electricity and access to clean cooking energy and electricity with universal coverage, low emission and security of supply will characterize the energy parameters of India in 2040. The energy mix will also undergo a transformation with preponderance of renewable technologies, storage solutions, smart grids and enlightened consumer behaviour becoming the order of the day.

By 2040, it is expected that the Indian energy market will be fully evolved with increasing supply requirement to meet demand on the basis of competitive markets. The rising share of private sector electricity supplies, oil, gas, coal, and renewables both in production and trade will transform the market by 2040.

Energy infrastructure needs a dedicated consideration because often the business environment for energy and infra are different, and separate policy frameworks are required. Here, we make a distinction between energy ‘production’ and ‘transport’ assets, with the latter being identified as infrastructure.

Along with focusing on the energy supply, proper infra policy integrated with energy policy needs to be adopted to address the infra needs of the diversified energy sector like the, LNG terminals, charging station for E-vehicles, trunk gas pipelines and coal washeries cannot be supported merely as infra assets. Unless they are linked with the energy policy, they will not come up by merely an infra support policy. All infrastructural assets have long life, thereby needing a stable policy environment. They involve lumpy investments and usually serve as ‘common carrier’ or cater to more than one client, and may come up merely by a financial investor. Their monopoly status needs to be regulated by a regulatory framework, just as their own financial viability needs assurance of business over long tenures.

Enhanced energy supply will require a large expansion in energy infrastructure along the entire value chain, and will have been created during the period up to 2040. Just as the country is going in for optic fibre backbone across the country, gas pipelines and electric transmission lines will have net-worked the entire country. LNG terminals, city gas distribution grids, strategic and commercial oil and gas storages, renewable energy projects (both grid connected and rooftop) will have sprung up to deliver energy to all parts of India. India has the advantage of offering a new market, for which latest technology will be the norm in infrastructure creation. It is acknowledged that it is more cost effective to adopt latest technology when building new rather than retrofitting, which is the case in the West. The advent of new technology and cost reduction in storage options (battery among others), will facilitate exploitation of the abundant renewable resource. The near 30-35% share of renewable energy in electricity mix will see a different kind of infrastructure — distributed and decentralized — than the capital intensive and centralized ones that exist in the West.