The Indian diesel genset market estimated to value $1,039.7 million in 2018 is projected to reach $1,518.1 million by 2024, demonstrating a CAGR of 6.5% during the forecast period. This growth is expected to be driven by the high demand and adoption of medium- and high-horsepower diesel gensets across the country. Furthermore, macroeconomic growth, coupled with revival in infrastructure, growth in manufacturing, and increase in commercial construction projects, is expected to boost the demand for these gensets for meeting prime and auxiliary power requirements in several facilities and plants in the coming years.

A diesel genset or a diesel generator set is an integrated system comprising a diesel engine and an electric generator that work in conjunction to produce electricity. The electricity produced by the genset is used for meeting power requirements.

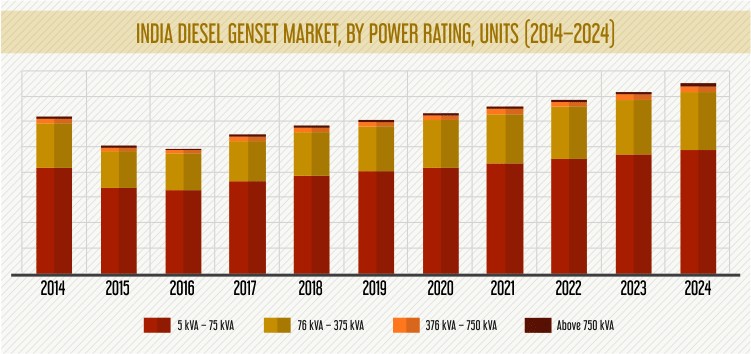

On the basis of power rating, the market is classified into 5 kVA–75 kVA, 76 kVA–375 kVA, 376 kVA–750 kVA, and above 750 kVA diesel gensets. In terms of volume, the category of 5 kVA–75 kVA gensets is estimated to hold the largest share in the Indian diesel genset market in 2018. These gensets are employed in high volumes at residential and small commercial installations, construction projects, and telecom towers. Besides, since these generators are manufactured by a large number of market players in both organized and unorganized sectors, they are generally competitively priced.

Besides, factors such as investments in the telecom sector and growing installation of tower towers for connectivity in remote locations, coupled with improvements in current network capabilities, are expected to support the demand for these gensets in the Indian diesel genset market.

The Indian diesel genset market is also categorized into commercial, industrial, and residential applications. Of these, gensets for commercial application are estimated to contribute the largest revenue to the market in 2018. This can be mainly attributed to the high demand for diesel generators in telecom towers, commercial offices, hospitals, and hotels. Additionally, growing cloud adoption by public and public players, increasing focus of telecom companies toward high-speed services, and construction of captive and colocation data centers are expected to drive the demand for these gensets during the forecast period.

In terms of volume, nearly half of the demand in the Indian diesel genset market is estimated to be generated by Tamil Nadu, Andhra Pradesh, Karnataka, Maharashtra, and Uttar Pradesh in 2018. This can be mainly attributed to the high regional demand for these gensets in various application areas, including telecom towers, residential facilities, construction projects, and manufacturing plants, for meeting prime and auxiliary power requirements.

India Diesel Genset Market Dynamics

Trend

The implementation of Bharat Stage VI (BS-VI) emission standards for internal combustion engines in 2016 and their nationwide rollout expected by 2020 can be viewed as a major trend observed in the Indian diesel genset market.

Under the proposed guidelines, diesel gensets of different power ratings are expected to comply with the smoke limit and other criteria laid out for particulate matter (PM) and gaseous emissions. From a manufacturing standpoint, this is expected to lead to structural reforms and significant technological overhaul in manufacturing and final product configurations. However, the transition is expected to be smooth due to the pre-existing production of standard-compliant products for export markets.

Drivers

Growth in end-use industries such as manufacturing and construction is expected to result in the generation of a high-volume demand for diesel generators for commercial applications, thereby driving the Indian diesel genset market.

The Indian manufacturing industry is poised for growth on account of private and public investments, government schemes, development of special economic zones, and improvement in transportation and logistics network. Diesel generators are widely employed in manufacturing facilities owing to uncertainty, power-intensive production lines, and the need for a reliable backup power source. Thus, growth in the manufacturing industry during the forecast period is expected to drive the demand for diesel generators in the country.

Besides, growth in the residential and commercial real estate market of India has picked up in recent years, on account of increased transparency, rapid urbanization, and development in the IT/ITeS sector. Increased customer confidence in residential real estate, in coherence with growth in commercial construction projects such as commercial offices, hotels, metros, and telecom towers, is expected to translate into the widespread adoption of diesel generators to meet prime and backup power requirements in the country. Furthermore, construction and localization of data centers is anticipated to act as an inflection point for the generation of a high demand for these generators, thereby positively impacting the Indian diesel genset market.

Restraints

Increasing penetration of electricity grids and growing implementation of laws and regulations aimed at curbing environmental emissions are expected to hinder the growth of the Indian diesel genset market in the near future.

In recent years, the regulatory agencies in India have adopted stringent regulations for diesel generators owing to the detrimental environmental impact and carcinogenic nature of these gensets. Additionally, the country has made significant progress in energy generation, with its grid capacity increasing from 199.9 GW in 2012 to 344.0 GW in 2018, complemented by electrification of over 16.7 million areas during the same period. This shift toward power generation through electricity grids has lowered the traditional dependency on diesel gensets across several regions in the country, thus hampering the growth of the Indian diesel genset market.

India Diesel Genset Market Competitive Landscape

Some of the major players operating in the Indian diesel genset market are Kirloskar Oil Engines Limited, Ashok Leyland Limited, Greaves Cotton Limited, VE Commercial Vehicles Limited, Mahindra Powerol Ltd., Cummins India Ltd., and Caterpillar Inc.

The Indian diesel genset market is characterized by the presence of several organized and unorganized players. The organized sector of the market is highly concentrated, with Cummins India Ltd., Kirloskar Oil Engines Limited, Mahindra Powerol Ltd., and Caterpillar Inc. operating as key players. These players have strong in-house R&D capabilities and offer differentiated portfolios of diesel generator sets.

Besides, the Indian diesel genset industry has witnessed a number of product launches in recent years. For instance, in September 2018, Perkins, a subsidiary of Caterpillar Inc., announced the launch of its six-cylinder, 23-liter 4006 electronic engine. The genset is electronically controlled, is compatible with Perkins EST diagnostic tool, and generates 750 kVA of prime power. The product is manufactured at the company’s Aurangabad facility in Maharashtra and is expected to serve a vast customer base in the country in the coming years.